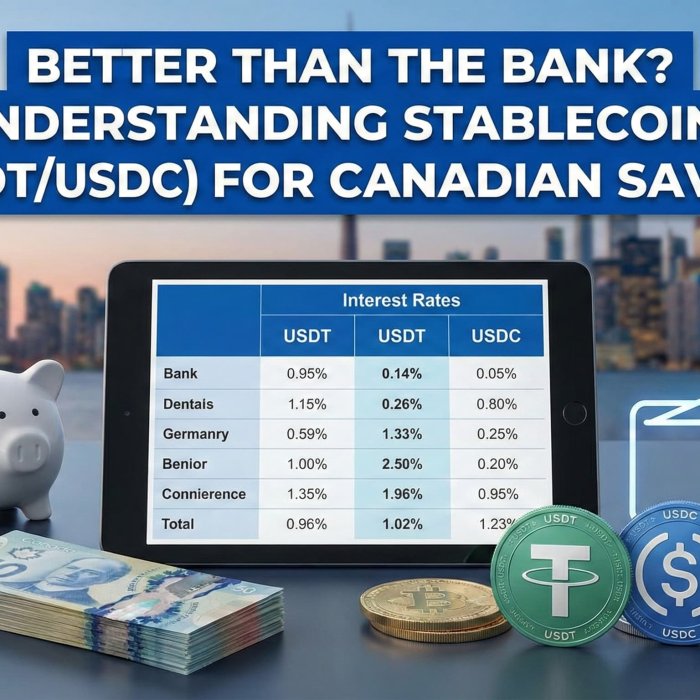

Better Than the Bank? Understanding Stablecoins (USDT/USDC) for Canadian Savers

If you’ve been paying attention to cryptocurrency but haven’t taken the plunge, stablecoins might be the entry point you’ve been waiting for. Unlike Bitcoin...

If you’ve been paying attention to cryptocurrency but haven’t taken the plunge, stablecoins might be the entry point you’ve been waiting for. Unlike Bitcoin...

Converting cryptocurrency to Canadian dollars involves more than just clicking “sell.” Understanding liquidity—how quickly and efficiently you can convert...

Windsor residents interested in cryptocurrency face a choice that investors in Toronto or Vancouver don’t have to think much about: should you use an online app like...

You’ve decided you want to buy some cryptocurrency. Maybe a friend mentioned it, maybe you’ve been watching Bitcoin’s price over the years, or maybe...

Windsor has always been a city that understands both sides of the border. With Detroit’s skyline visible from the riverfront and thousands of residents crossing daily...

Windsor investors face an interesting decision in 2026: With local real estate showing signs of stabilization and Bitcoin consolidating after its 2025 volatility, which asset...

Ready to convert your Bitcoin to Canadian dollars? Whether you’re taking profits, need cash for a purchase, or rebalancing your portfolio, selling Bitcoin in Windsor...

Canadians lost $103 million to cryptocurrency scams in the first half of 2025 alone—and Windsor’s border city position makes residents particularly attractive...

Ready to buy your first cryptocurrency in Windsor? You’re joining thousands of Canadians entering the crypto market—approximately 13% of the population now holds...